Criminals launder the astronomical sum of $1.6–$4 trillion dollars per year. According to United Nations data, that equals 2%–5% of the world GDP. Almost all illegal funds go through the banking system. Banks consider the Know Your Customer (KYC) policy the first line of defense to fight money laundering and financial terrorism. However, even compliance with all requirements of advanced international standards don’t guarantee complete protection from financial crime. In 2019 alone, banks and financial institutions were fined about $36 billion for anti-money laundering (AML) and KYC malfunctions.

Even today, the KYC process is carried out pretty much manually, making it an expensive and time-consuming procedure that’s vulnerable to human error, risk, and failures. Outdated banking KYC solutions can’t cope with the flow of suspicious transactions or properly ensure complex customer verification. Crimes are committed, and fraudsters find vulnerabilities.

Blockchain technology increases the level of personal data security, and it’s just one reason why blockchain KYC is a sound solution for financial institutions. At Unicsoft, we specialize in developing decentralized applications (dApps). We develop dApps that integrate with existing business processes to decentralize operations and make them more secure. The smart contracts we develop guarantee secure execution of complicated agreements and predetermined obligations. So it’s time for our practical insights, just keep reading.

How do banks implement KYC solutions today?

According to a Thomson Reuters survey, financial institutions spend anywhere from $60–$500 million annually, keeping up with KYC rules and customer due diligence. Even though investments are allocated in both directions, KYC procedures remain complicated, time-consuming, and inefficient.

Survey data from corporate banking clients are just as telling: 89% of clients had a bad KYC experience, and 13% of them changed financial institutions. The time it takes to complete KYC processes — reportedly two to four months — drags out the process of integrating new customers and strains relations with clients. Companies attribute the length of the process to multiple factors, such as the volume of constant changes in regulatory requirements and a lack of specialists qualified to conduct KYC procedures. And if financial institutions hire more specialists to carry out KYC verifications, it increases personnel expenses, which decreases their profits.

Banks spend a lot on regulatory compliance but continue to lose money to fraud — about 5% of their annual income.

Banks frequently face the following problems with conducting KYC processes:

- User information is replicated each time (there is no single source, that is, a single interbank database, and every time a client undergoes KYC in different banks, the whole process restarts from scratch).

- Transitions are visible only within one institution and cannot be checked by others.

- Data collection is manual, which is tedious, slow, and prone to error.

- Manually processing data affects its objectivity.

- Fully-centralized processes increase the risk of personal information misuse and vulnerability to hacks like DDoS and fishing attacks.

- Frequent sharing of personal information, multiple management systems, different communication protocols, and outdated approaches to data transfer result in errors.

The ubiquity of internal and external threats requires radical reinvention of KYC processes. A centralized system vulnerable to intrusions can be replaced by a decentralized system with automatic processing of large data streams, thus minimizing human intervention. Blockchain-based products are precisely the solution banks need.

Shortcomings of traditional KYC tools

Above all, traditional KYC tools are labor-intensive and inefficient. They fail to protect and prevent increases in criminal activity. According to research, shortcomings of KYC procedures include lack of data, insufficient precision, and growth in false-positive verification results. Criminals use various methods (e.g., spoofing, fake IDs, shell companies) that financial institutions must identify and prevent.

According to Swiss company Finanso, in 2023, the value of digital payments will amount to $1 trillion. And that number accounts for only the European market! Andrea Enria, chair of the Supervisory Board of the European Central Bank (ECB), noted that Fintech and major technology companies are now competing with banks. According to Enria, in 2020–2021, European users of digital channels and products increased from 81% to 95%.

The rapid development of new-generation banks (digital banks and neobanks), together with the blockchain market, creates the need to ensure simple, secure, digital access to financial products. To meet that need, we must invest in digital technologies. The technology sector provides modern transformations and solutions that boast security, effectiveness, and cost savings. Automating labor-intensive processes helps financial companies comply with regulatory mechanisms while also focusing on improving the customer experience.

The financial sector has taken confident steps toward adopting digital technologies and has demonstrated steady progress. There’s no need for each institution to finance development of their own solutions. AI and blockchain technologies can complement internal processes with automated digital technologies that enhance KYC measures.

Why move towards blockchain KYC technologies?

Blockchain technologies enable quick, effective, accurate, and secure compliance with regulatory requirements. For example, the UAE KYC Blockchain Consortium (which includes the Commercial Bank of Dubai as a founding member) launched a KYC blockchain consortium in February 2020. In 2021, it processed no less than half of all of Dubai’s corporate KYC verifications. According to Abdulla Hassan, CEO of the Dubai Economy Corporate Sector, the blockchain consortium simplified the opening of bank accounts for investors and let banks obtain verified data about their clients in digital form.

Blockchain-based KYC solutions for banks are essential for financial institutions: creating an automated platform that prevents cyber threats, provides enhanced real-time validation, improves customer service, simplifies transactions, improves compliance, and enables continuous monitoring of employees and business customers to assess risks and analyze data.

How does using blockchain for KYC help banks?

Decentralized governance, anonymity, and customer protection are the basic principles of the crypto industry. KYC procedures do not eliminate all the advantages of decentralized crypto markets, since they protect users and their assets on crypto platforms, performing the same function they do for the banking sector: they prevent criminal offenses.

Blockchain principles — immutability of records, increased confidentiality, a decentralized register that simplifies access to the information, increases transparency, trust, and data security — must be used for KYC procedures to make them more efficient.

Standardizing and sharing information when opening accounts on a blockchain establishes unified KYC records protected from unauthorized access. Joined forces make blockchain a vital tool for KYC processes that preserve compliance with anti-money laundering (AML) rules.

Benefits of blockchain KYC solutions for banks

Blockchain opens up new perspectives and opportunities for development in the banking sector:

- Single shared data system. Blockchain architecture can consolidate data from multiple service providers into a single decentralized cryptographic system. Unlike manual KYC procedures, verification and authentication are carried out without third-party involvement. Organizations can share KYC with each other. Thus, the blockchain architecture forms a general data register where users will need to undergo the KYC procedure to verify their identity only once.

- Distributed ledger. Blockchain technology creates a distributed ledger that stores information about trusted identities that all users on the network can use. This eliminates a single ruling body and the vulnerabilities inherent in a client/server model.

- Database immutability. Blockchain databases are characterized by built-in immutability, making the storage of identification data more secure.

- Robust security. The security level protecting personal data is increased in all spheres connected with data verification.

- Network decentralization. Monopolized control is eliminated because data is stored in a decentralized network. Only users with special permission can access it, minimizing illegal actions.

- Standardized procedures. All participants in the financial market follow the same processes. KYC encoding in smart contracts standardizes KYC procedures, reduces errors, and prevents data loss.

- Efficient operations. Time spent on KYC procedures is reduced thanks to digitalizing, standardizing, and automating.

- Reduced errors. Human error is removed from the process.

- Crime control. Blockchain technology can detect fraud and reduce loss.

- Transparency. Confidence in the financial sector increases.

- Risk reduction. The risk of legal requirement violations by KYC service providers is prevented or reduced.

Steps to introduce blockchain KYC solutions for banks

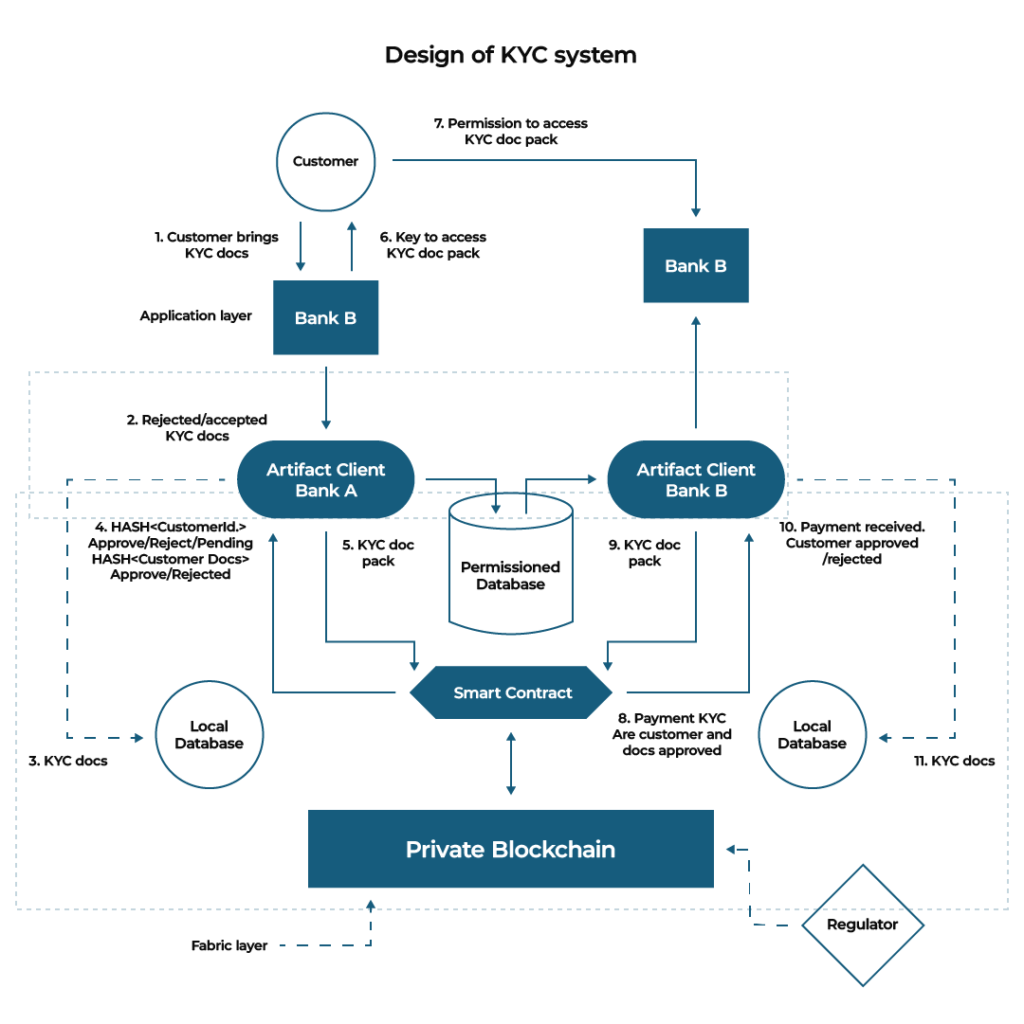

A blockchain-based KYC architecture ensures transparency while improving data storage security. The following model demonstrates how it works.

Source: ResearchGate.

KYC procedures are carried out as follows:

- A user needing a banking service, like taking out a loan, submits documents to a bank, and the bank initiates the KYC procedure.

- All participants of the blockchain system (governmental institutions, banks, and others) are responsible for collecting and storing the user’s personal information in a decentralized network.

- After automated verification, the bank confirms that the user passed the KYC checks (documents are valid and the information provided is true), and enters the client’s data into a blockchain platform. Since all participants in the network can access the system, the parties can control and regulate the whole KYC process.

- The system itself monitors changes and updates user data. If it detects a violation of rules, the system notifies all parties.

- If a user opens an account at another bank, that bank accesses the decentralized system to confirm the client’s identity (rather than entering the user’s information and verifying it anew).

- Users can log in with a private key to confirm their identity and perform data exchanges. All processes with access to personal information can be carried out only with the client’s consent.

Unicsoft’s practical implementation of a blockchain KYC solution for an entire national banking system

Unicsoft’s client sought to optimize the verification process and eliminate identity theft for an entire national banking system. The nation’s financial institutions were using fingerprint detectors to verify user identity. Expensive equipment did not prevent fraudsters from bypassing the system, which opened up possibilities for illegal transactions.

The client decided to try face validation for personal identification and made it work effectively for various banks and their respective customer bases.

How did the Unicsoft team meet the project goals?

The banking staff used webcams to photograph and initiate the account opening and verification process for clients. Then, the bank requested verification of the potential client’s identity using the blockchain consortium. Next, the consortium performed an automated biometric comparison of the photograph with a photographic database that all partners contributed to.

However, the Unicsoft team faced an obstacle: images that belonged to each of the partner banks can’t ever be shared, copied, or processed without encryption. To bypass this constraint, each photo was converted into an embedding (a mathematically obtained number representing the picture). This number was transferred through a decentralized registration system.

Partners received a request for an individual comparison of the bank’s photograph with a specific image in the database based on the image’s unique identifier. Each partner’s node performs the comparison and generates an overall score, which is sent to the partner who initially made the request.

Unicsoft’s KYC solution identified matches with the photographic database and enhanced the efficacy of positive and negative verifications of potential clients. The project’s primary result was expanded access for clients to financial services and democratization of the services.

How do you make a blockchain KYC project successful?

Linking blockchain technology through a KYC solution to a nationwide banking system allowed our experts to study how Blockchain technology impacts KYC procedures in banks and influences related services. In addition, we anticipated risks and challenges associated with the project. We’ve gathered the following takeaways you should keep in mind when considering your own blockchain-based KYC project:

- Take legal particulars into account because banking and finance are highly regulated domains with dozens of country-specific rules.

- Decide on a blockchain type — public, private, or consortium. In this case, we used a blockchain consortium because all participants needed equal power and rights. In contrast to a public blockchain, the consortium only accepted pre-selected participants. Therefore, this type of blockchain isn’t open to everyone but is semi-private.

- Keep limitations of blockchain performance in mind. Blockchains are slower than their centralized counterparts — you can’t process millions of transactions per second with blockchains. To minimize this limitation, avoid overloading the system with “heavy” UI/UX elements.

If you’d like to learn more about this project, feel free to drop us a line.

Conclusion

Current KYC procedures with manual control, lots of inaccuracies, and a high risk of data theft are inefficient. Thus, Fintech institutions have searched for innovative data storage and security methods.

Blockchain KYC proves to be a wise solution. It reduces the time required for KYC, increases personal data security, prevents unauthorized data access, and provides opportunities to promptly identify illegal schemes. Unicsoft specializes in KYC blockchain solutions and can be your reliable partner in this field.

![How to Implement KYC Solutions for Banks that Are Really Effective (Spoiler Alert: Blockchain Detected) What’s the EU Artificial Intelligence Act and How to Comply? [Webinar]](https://unicsoft.com/wp-content/uploads/2024/03/Cover_1140_v1.1-370x280.png)